kansas sales tax exemption certificate

If you hold a tax exemption certificate in one of these states make sure you renew as required to avoid. Businesses with a general understanding of Kansas sales tax rules and regulations can avoid costly errors.

Amazon Tax Exemption Program Atep

Street RR or P.

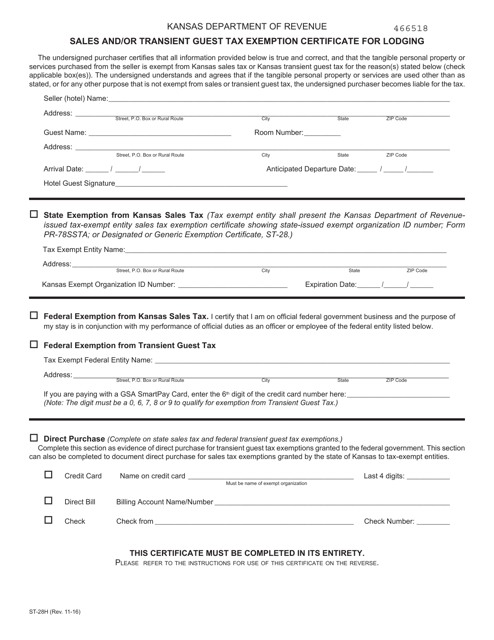

. Certificate to be filed with purchase. 11012014 The tax-exempt entity understands and agrees that if the tangible personal property andlor service are used other than as stated. This use tax applies to purchases of goods from businesses in other states and its purpose is to protect Kansas businesses from unfair competition from.

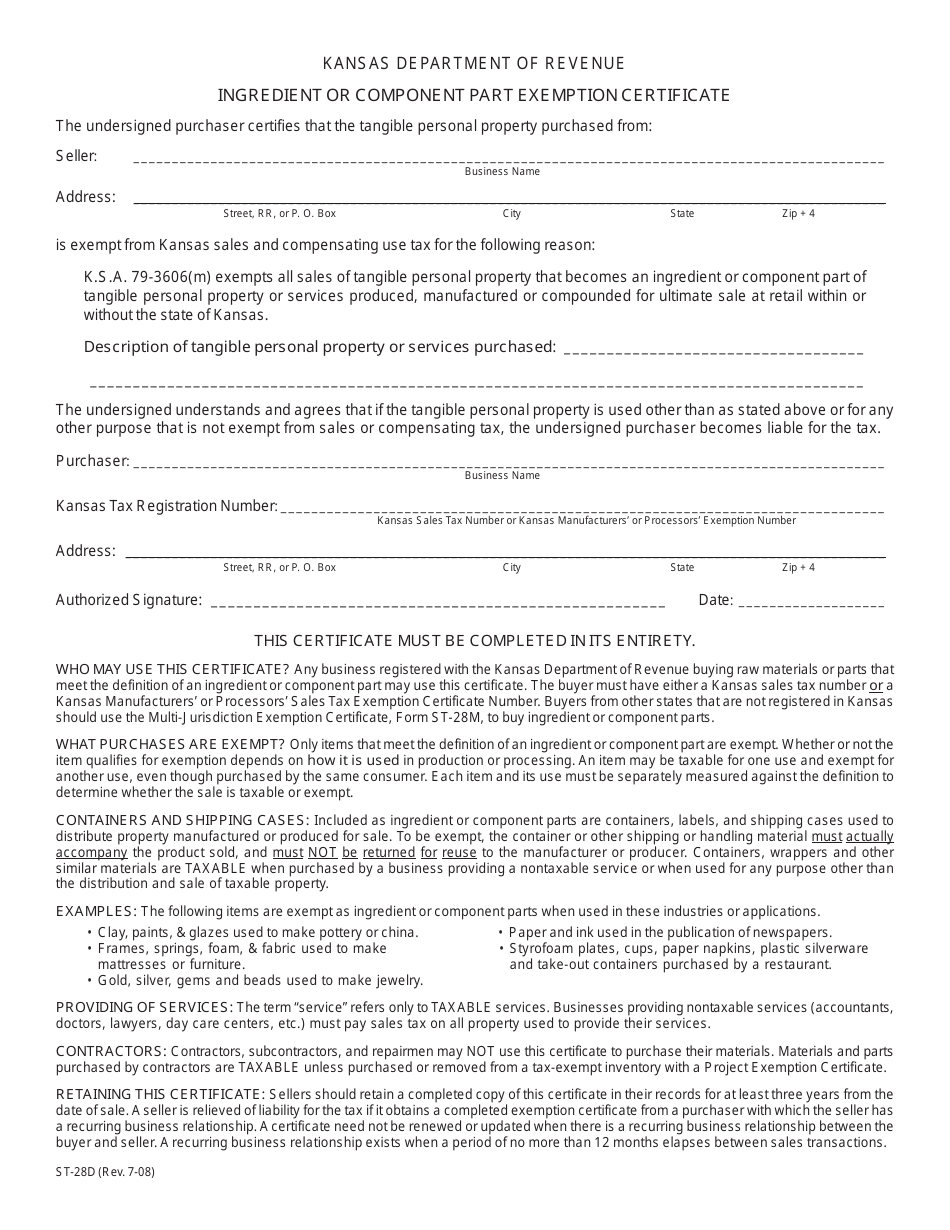

You can download a PDF of the Kansas Contractor Retailer Exemption Form ST-28W on this page. This booklet is designed to help businesses properly use Kansas sales and use tax exemption certificates as buyers and as sellers. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Kansas Department of Revenue. Your Kansas Tax Registration Number. If you have an SSUTA you can use this form as both a seller and a.

The information contained in this. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. No sales tax levied.

Florida Illinois Kansas Kentucky Maryland Nevada Pennsylvania South Dakota and Virginia. And all sales of repair. Ad Register and Subscribe Now to work on your KS CR-16 more fillable forms.

Sellers should retain a. While groceries are not tax exempt any food that is used to provide meals for the elderly or homebound is considered to be exempt. 000-0000000000-00 Copyright 2017 Kansas Department of Revenue.

Need to file application. For other Kansas sales tax exemption certificates go here. The purpose of this form is to simplify the reporting of your sales and use tax.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Need to file application. All construction materials and prescription drugs including prosthetics and devices used to increase mobility are considered to be exempt.

Contact General Accounting at 785-532-6202. You must first be registered with Streamlined Sales Tax Registration System and have an account set up in order to use this form. Accessibility Policy Contact Web Master Terms of Use.

An exemption certificate must be completed in its. Sales tax exemption certificates may also be used to claim exemption from compensating use tax. Contact General Accounting at 785-532-6202.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. A sales tax exemption certificate can be used by businesses or in some cases individuals. For other Kansas sales tax exemption certificates go here.

It explains the exemptions currently authorized by Kansas law and includes the exemption certificates to use. Form to be filed with purchase. Sales and Use Tax Entity Exemption Certificate.

Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. A Kansas resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

The buyer furnishes the exemption certificate and the seller keeps the certificate on file with other sales tax records. _____ Business Name. It shows why sales tax was not charged on a retail sale of goods or taxable services.

Presents to a retailer to claim exemption from Kansas sales or use tax. The appropriate Kansas exemption certificate from your customer is to be obtained at the time of the sale or no later than the actual delivery of the taxable item or service. 79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible personal property in a warehouse or distribution facility in Kansas all sales of installation repair and maintenance services performed on such machinery and equipment.

Certificate which can be provided to any vendorsupplier that shows KDA is exempt from sales tax. Sales and Use Tax Entity Exemption Certificate The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. This notice is available by calling 785-368-8222 or from our web site.

1320 Research Park Drive Manhattan Kansas 66502 785 564-6700. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. Certificates last for five years in at least 9 states.

Most exemptions from sales tax require a buyer to present an exemption certificate and the exemption is to be on file in the selling department to avoid the collection of sales tax. Kansas Sales Tax Exemption Certificate information registration support. 10012024 The tax-exempt entity understands and agrees that if the tangible personal.

Drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number either on this certificate or the Multi-Jurisdiction Exemption Certificate for the sale to be exemptIf the out-of-state retailer DOES NOT have sales tax nexus with Kansas it may provide the third party vendor a resale exemption certificate evidencing. How to use sales tax exemption certificates in Kansas. Is exempt from Kansas sales and compensating use tax for the following reason.

2012-2016 Department of Agriculture Office Use. How long are tax exempt certificates good for. Ad New State Sales Tax Registration.

Box City State Zip 4. Tax exemption certificates last for one year in Alabama and Indiana. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA.

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate 2008 Templateroller

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller